Disclosures Under Section 4 (1) (b) Of The RTI

The particulars of its organization, functions and duties:

Tiruchirappalli Customs (Preventive) Zone is a part of Central Board of Indirect Taxes and Customs (CBIC), the Department of Revenue under the Ministry of Finance, Government of India. Tiruchirappalli Customs (Preventive) Zone deals with the task of levy and collection of customs duties, prevention of smuggling and evasion of duties. Tiruchirappalli Customs (Preventive) Zone discharges its various functions through the Commissionerates under its jurisdiction.

The Chief Commissioner is the head of Tiruchirappalli Customs (Preventive) Zone, which has jurisdiction over the Customs work (Import and Export and Prevention of smuggling) in the whole of the State of Tamil Nadu (excluding the areas falling under the jurisdiction of the Principal Chief Commissioner of Customs, Chennai Zone) and Puducherry Union Territory except Mahe and Yenam.

- The Chief Commissioner (CC) exercises administrative control and supervision over the entire Tiruchirappalli Customs (Preventive) Zone.

- The Chief Commissioner monitors proper implementation of Customs laws and Allied laws including instructions/guidelines issued by the Central Government from time to time on administrative, technical and vigilance matters.

- The Chief Commissioner discharges certain statutory functions bestowed on him under the Customs statute.

- The Chief Commissioner is also a member of the committee that reviews the adjudication orders passed by the Commissioners in the Zone/s for their legality and propriety.

- The Chief Commissioner reports directly to the Central Board of Indirect Taxes and Customs, Ministry of Finance, New Delhi.

The Tiruchirappalli Customs (Preventive) Zone is divided into two Commissionerate viz. Tiruchirappalli Customs (Preventive) Commissionerate and Tuticorin Customs Commissionerate. They supervise in monitoring revenue collection, formulation of the trade facilitation measures, preventive and anti-smuggling checks, recovery of arrears, disposal of pendencies, redressal of the grievances and complaints of the trade/public.

The main functions of the Commissionerates include the levy and collection of custom duties, prevention of smuggling and evasion of duties, besides all administrative matters relating to customs formations under this zone.

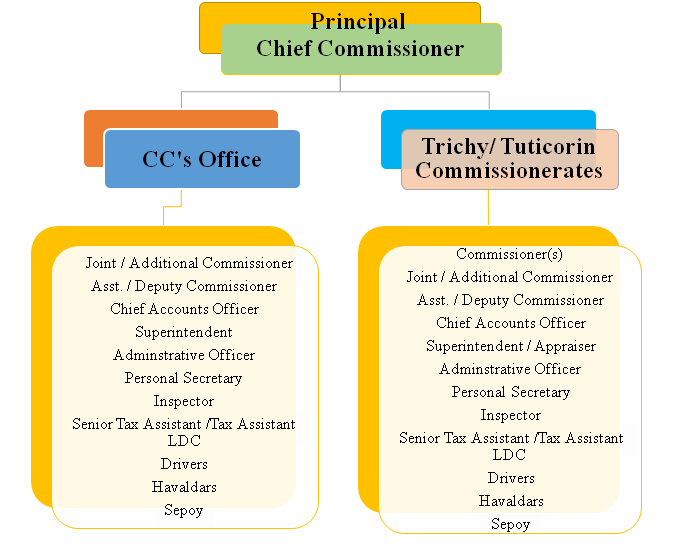

ORGANIZATION SETUP AND DUTIES:

The hierarchy of the officers is as under:

- Overall supervision of this Zone is looked after by the Chief Commissioner Office (CCO).

- The CCO is headed by the Chief Commissioner of Customs (Preventive) and assisted by Joint / Additional Commissioner, Assistant/ Deputy Commissioner, Chief Accounts Officer, Superintendents, Inspectors and other supporting staff.

- This Zone is divided into two Commissionerates namely Tiruchirappalli Customs (Preventive) Commissionerate and Tuticorin Customs Commissionerate.

- The overall affairs of this Commissionerate are supervised by respective Commissioners with help of other officers/staff. The working of this Commissionerate is regulated through Dy./Assistant Commissioner and assisted by Appraisers and Superintendents who are entrusted to look after the daily working of this Zone. The basic executive functions are performed by Inspectors. The other works are supported by STA/TA/LDC. The Sepoys/Hawaldars are responsible for ensuring safety & security of office premise along with works related to dispatch of daily correspondence, movement of files and records, opening and closing of office etc.

POWERS AND DUTIES OF OFFICERS AND EMPLOYEES[Section 4(1(b)(ii)]:

The powers and duties of the officers are defined in the Customs Act, 1962 and GST Act, 2017 and the Rules made there under, which are available in public domain.

| Designation of the Officer | Powers and Duties of the Officer |

|---|---|

| Chief Commissioner | The Chief Commissioner is the Administrative Head of the Zone. He/She shall oversee collection of targeted revenue every year and shall report to the Central Board of Indirect Taxes & Customs (CBIC). He/She exercises control over the Commissioners of Tiruchirappalli and Tuticorin in the zone. |

| Joint/ Addl. Commissioner | The Joint/ Addl. Commissioner assists the Chief Commissioner in all matters. He/She supervises and has control over all the staff working in Chief Commissioner's office. |

| Asst. /Deputy Commissioner | Assistant / Deputy Commissioner assists the Chief Commissioner and Joint / Additional Commissioner in matters allotted to him/her. He/She supervises and has control over the sections allocated to him/her. |

| Chief Accounts Officer | The CAO assists the Chief Commissioner and Joint/Additional Commissioner in matters related to Administration, Accounts, DDO and Establishment. |

| Superintendent / Administrative Officer | Superintendent/Administrative Officer assists the Chief Commissioner, Joint / Additional Commissioner,Deputy/Asst. Commissioner in the matters of work allotted to him/her. He/She supervises and has control over the sections allocated to him/her. |

| Inspector/Executive Assistant/Tax Assistant/LDC | Inspector/Executive Assistant/Tax Assistant assists the Chief Commissioner, Joint/ Additional Commissioner, Deputy/Assistant Commissioner, Chief Accounts Officer / Superintendent / Administrative Officer in the matters of work allotted to him/her. |

(iii) Rules/orders under which powers and duties are derived:

Instructions contained in the Government of India (Allocation of Business) Rules, 1961, the Government of India (Transaction of Business) Rules, 1961 and Manual of Office Procedure are followed during discharge of functions.

(iv) Work allocation:

As mentioned in the Table above.

PROCEDURE FOLLOWED IN DECISION MAKING PROCESS [Section 4(1()b)(iii)]:

(i) Process of Decision Making – Identify key decision-makingpoints:

Office of the Chief Commissioner of Customs (Preventive) is primarily an administrative / monitoring unit. It monitors the activities of Executive Commissioneratesfalling under the zone.

(ii) Final Decision-MakingAuthority:

Commissionerate is headed by a Commissioner, who is the final decision-making authority with regard to disputes regarding levy and collection of Customs Duty in his/her jurisdiction.

(iii) Related provisions, Acts, Rules etc.:

The procedure followed by the officers in the decision-making process and different aspects of supervision, accountability for taking decisions are outlined in the Customs Manual, the Adjudication Manual, Audit Manual, Customs Appraising Manual and Customs Preventive Manual etc. The procedure indicated in Manual of Office Procedure (MOP) are also followed for decision-making.

(iv) Time limit for taking decisions:

Time limit for taking decisions are outlined in the respective laws/ Rules / Manual etc.

(v) Channel of supervision and accountability:

Commissionerates are supervised by Commissioner. The Commissioner is assisted by Additional/Joint Commissioners and other officers in the Commissionerate Headquarters office / Custom House.

There are subordinate field formations called Divisions which are supervised by Deputy/Assistant Commissioner and the field formations (Preventive Units/ ICDs/CFS) are supervised by Superintendents who are assisted by Inspectors. The overall control of the Zone is vested with the Chief Commissioner.

NORMS FOR THE DISCHARGE OF ITS FUNCTIONS[Section 4(1 (b)(iv)]:

(i) Nature of functions/ services offered:

To carry out the mission of CBIC to administer Customs and GST and Central Excise, laws aimed at:

- realizing the revenues in a fair, equitable and efficient manner;

- administering the Government's economic, tariff and trade policies with a practical and pragmatic approach;

- facilitating trade and industry by streamlining & simplifying Customs processes and helping Indian businesses to enhance their competitiveness;

- creating a climate for voluntary compliance by providing guidance and building mutual trust;

- combating revenue evasion and commercial frauds in an effective manner.

(ii) Norms/ standards for functions/ service delivery:

To The said objectives are sought to be achieved by:

- enhancing the use of information technology;

- streamlining the procedures;

- encouraging voluntary compliance;

- evolving cooperative initiatives.

(iii) Process by which these services can be accessed: Not Applicable

(iv) Time-limit for achieving the targets: Time limit for taking decisions are outlined in the Customs Manual etc.

(v) Process of redress of grievances:

The aggrieved citizens may submit their grievances online through CPGRAM Portal for speedy and favorable redressal at https://pgportal.gov.in/ or by any other mode.

The grievances received are examined by the Section dealing with the matter and if found genuine necessary action for redressal of the same is taken accordingly by the competent authority. If the grievance pertains to the filed formations under the jurisdiction of this office, the same are forwarded for their comments or necessary action and final decision is taken based on the verification report received from the field formations. Decision on the grievances is conveyed to the CPGRAM portal or by Post, from where the same is received.

Directory Of Officers

| S.No | Name of the Officer S/Shri/ | Desingation | Contact No. |

|---|---|---|---|

| 1 | Shri K.R. Uday Bhaskar, I.R.S. (C&IT), | Chief Commissioner | 0431-2416255 |

| 2 | Shri. P. Ram Mohan, I.R.S. (C&IT), | Additional Commissioner | 0431-2415612 |

| 3 | Dr. G. Pravin Gavaskar, I.R.S. (C&IT), | Deputy Commissioner | 0431-2410550 |

| 4 | K. SIVAKUMAR, I.R.S. (C&IT), | Assistant Commissioner | 0431-2410550 |

| 5 | C. Annalakshmi, | Chief Accounts Officer | 0431- |

Monthly Remuneration Received By Officers And Employees

| S.No | Name of the Officer S/Shri/Smt | Designation | Level | Pay Scale |

|---|---|---|---|---|

| 1 | Shri K.R. UDAY BHASKAR, I.R.S. | Chief Commissioner | 16 | 205400-224400 |

| 2 | P. RAM MOHAN, I.R.S. | Additional Commissioner | 13 | 123100-215900 |

| 3 | Dr. PRAVIN GAVASKAR G, I.R.S. | Deputy Commissioner | 11 | 67700-208700 |

| 4 | K. SIVAKUMAR, I.R.S. | Assistant Commissioner | 10 | 56100-177500 |

| 5 | C. ANNALAKSHMI | Chief Accounts Officer | 10 | 56100-177500 |

| 6 | K. VISHWANATHAN | Superintendent | 10 | 56100-177500 |

| 7 | C. GOVINDASAMY | Superintendent | 9 | 53100-167800 |

| 8 | P. RAMESH | Superintendent | 9 | 53100-167800 |

| 9 | S. REHANA BEGUM | Superintendent | 9 | 53100-167800 |

| 10 | K. SIVAKUMAR | Superintendent | 9 | 53100-167800 |

| 11 | ANTHONY PUSHPAM | Senior Private Secretary | 9 | 53100-167800 |

| 12 | M. VENKATESAN | Superintendent | 9 | 53100-167800 |

| 13 | SUNIL KUMAR | Superintendent | 8 | 47600-151100 |

| 14 | A S JAGADEESWARAN | Superintendent | 8 | 47600-151100 |

| 15 | K SEKARAN | Inspector | 7 | 44900-142400 |

| 16 | GAURAV AGARWAL | Inspector | 7 | 44900-142400 |

| 17 | NISHANT VIKRAM | Inspector | 7 | 44900-142400 |

| 18 | AJEET DAHIYA | Inspector | 7 | 44900-142400 |

| 19 | MURALIKRISHNAN R | Inspector | 7 | 44900-142400 |

| 20 | KULDEEP SINGH RAWAT | Inspector | 7 | 44900-142400 |

| 21 | DEVENDRA SINGH SIKARWAR | Senior Hindi Translator | 7 | 44900-142400 |

| 22 | C.MANIKANDAN | Executive Assistant | 6 | 35400-112400 |

| 23 | DURGA LAKSHMI | Executive Assistant | 6 | 35400-112400 |

| 24 | M. ASTALAKSHMI | Stenographer (Grade-I) | 6 | 35400-112400 |

| 25 | VIVEK KUMAR PATHAK | Stenographer (Grade-II) | 6 | 35400-112400 |

| 26 | R. GOVINDARAJ | Driver(Special Grade) | 6 | 35400-112400 |

| 27 | K. AKKINIMUTHU | Tax Assistant | 4 | 25500-81100 |

| 28 | RAHUL KUMAR | Tax Assistant | 4 | 25500-81100 |

| 29 | NIRAJ KUMAR SHARMA | Tax Assistant | 4 | 25500-81100 |

| 30 | S. PRAKASH | ASI | 3 | 21700-69100 |

| 31 | G. MURALI | Head Havaldar | 3 | 21700-69100 |

| 32 | M.S. ESWARAN | Head Havaldar | 3 | 21700-69100 |

| 33 | NEERAJ SINGH KIROULA | Havaldar | 1 | 18000-56900 |

| 34 | RAHUL P | Havaldar | 1 | 18000-56900 |

| 35 | S. SIVAKUMAR | MTS | 1 | 18000-56900 |

Budget Allocation

| Object Head | 15 Digit Code | Revenue Function (Rs. In thousands) |

|---|---|---|

| Salaries | 2037.00.101.01.01.01 | 410000 |

| Wages | 2037.00.101.01.01.02 | 4200 |

Details of Officers with charges held

| Name & Designation of the Officer | Charges Held |

|---|---|

| Shri K.R. Uday Bhaskar, I.R.S. (C&IT), Chief Commissioner |

Areas of Jurisdiction: 1) Commissioner of Customs (Preventive), Tiruchirappalli 2) Commissioner of Customs, Tuticorin. |

| Shri. P.Ram Mohan, I.R.S. (C&IT), Additional Commissioner |

Parliament Questions, Audit and PAC Matters and Trade / Associations Meetings; Review of Orders-in-Original issued by both the Commissioners of Custom in this Zone; Work relating to complaints / grievances from Public /Trade /Staff; Technical work handled in Chief Commissioners Office; Correspondence with the Board and other Agencies relating to Technical work; C.P.I.O. of CCO - Right to Information Act, 2005 Submission of all periodical Reports and Returns Personnel & Establishment / Vigilance matters in this Zone Administration and Vigilance work in Chief Commissioners office. Training Programs, Infrastructure matters Chief Commissioners Conference & Review Meetings & follow up and all other work assigned by the Chief Commissioner |

Dr. G. Pravin Gavaskar, I.R.S. (C&IT), Deputy Commissioner |

Customs Policy / Cost Recovery /SS Fund /Refund; Vigilance & Confidential /Rewards /CPGRAMS; Review of Order-in-Originals issued by both the Commissioner of Custom in this Zone; Inspection /Parliament Questions; Legal /Prosecution /CAT Matters; FAG /Drwabak; RTI; Adminstration /Establishment / Accounts; Work relating to Anti-smuggling /Directorate of Logistics; Technical work handled in Chief Commissioners Office; Vehicles; All other work assigned by the Supervisory Officers. |

Shri K. Sivakumar, I.R.S. (C&IT), Assistant Commissioner |

Work relating to Computerization /EDI /IT Website /E-office; Infrastructure matters; Sevottam; Video Conferences; Arrears Work relating to grievances from Public /Trade; Technical work handled in Chief Commissioners Office; AEO /Audit / Adjudication /Call Book; Training Programs; Stattistics /Brochures; Disposal; PRO; All other work assigned by the Supervisory Officers. |

Shri C. Annalakshmi Chief Accounts Officer |

Work relating to BEAMS Data /GPF, Medical, LTC and all claims; Pay Fixation including pay anomaly in all cadres/MACP; Budget Estimates and Expenditure exports. |